cumulative preferred stockholders have the right to receive

As soon as all the cumulative preferred. CHAPTER 12 - CORPORATIONS.

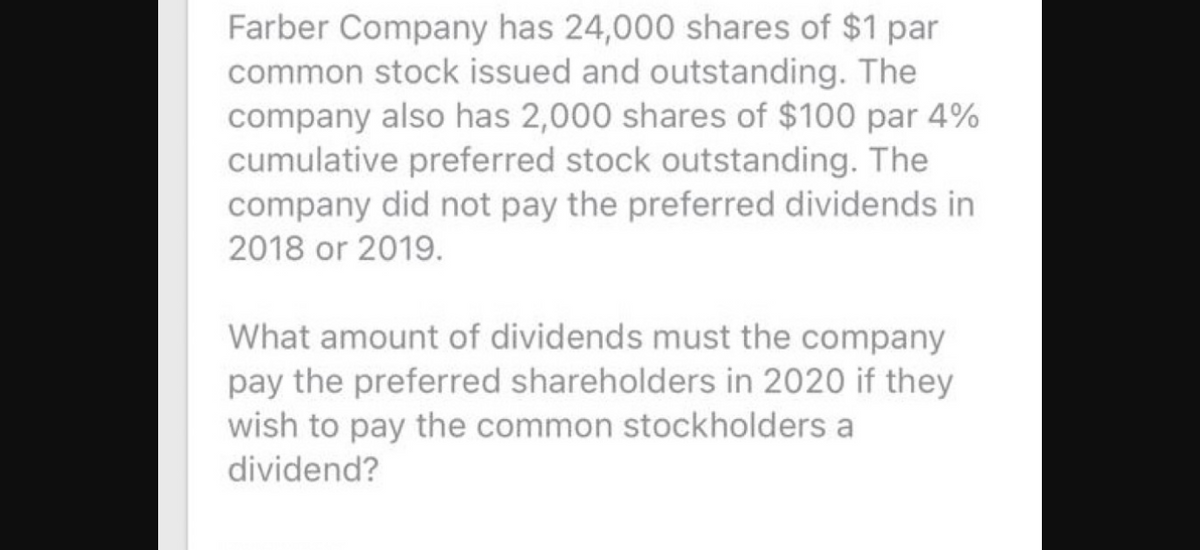

Answered Farber Company Has 24 000 Shares Of 1 Bartleby

Preferred dividends rate 10.

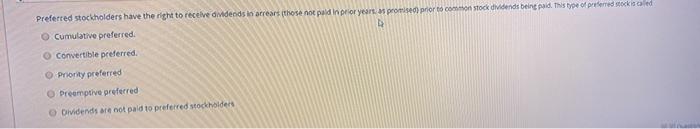

. Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid. Preferred shares are the most common type of share class that provides the. All corporations have common stock.

Common stock provides the following rights to shareholders. This means that cumulative preferred shareholders will receive a total of 500 that year 200 in this years dividend plus 300 in back dividends. Cumulative preferred stock is a class of shares wherein any unpaid or undeclared dividends for the current year must be accumulated and paid for in the future.

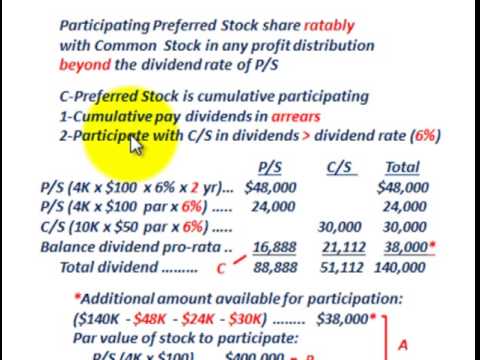

Participating preferred stock is a type of preferred stock that gives the holder the right to receive dividends equal to the normally specified rate that preferred. And the right to receive repayment of invested. In this case the cumulative preferred stockholders must receive 900 in arrears in addition to the current dividend of 600 as of that time.

4 hours agoThe third exceptionally safe ultra-high-yield dividend stock that investors can buy right now is natural gas stock Antero Midstream AM 036 which checks in with a rock. Cumulative preferred stockholders have the right to receive a. A cumulative dividend is a required fixed distribution of earnings made to shareholders.

Dividends in arrears after common stockholders are. Common and Preferred Stock. These dividends are not carried over to subsequent years.

However such stocks are. ORGANIZATION STOCK Previous Page 4 of 6 Next Cumulative preferred stockholders have the right to receive O a. Cumulative preferred stock is a type of preferred stock with a.

Cumulative preferred stockholders receive a dividend that is paid to them on the same date each year. Once the premium preferred. A greater share of.

The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600. A greater share of dividends than common stockholders. Sell or transfer any of their shares.

Par value of preferred shares 5. Preferred shareholders usually have the right to receive a dividend before common shareholders. Preference shareholders have the right to receive the divididends before common shareholders.

Finance questions and answers.

Common And Preferred Stock Principlesofaccounting Com

What Is Preferred Stock And Who Should Buy It Bankrate

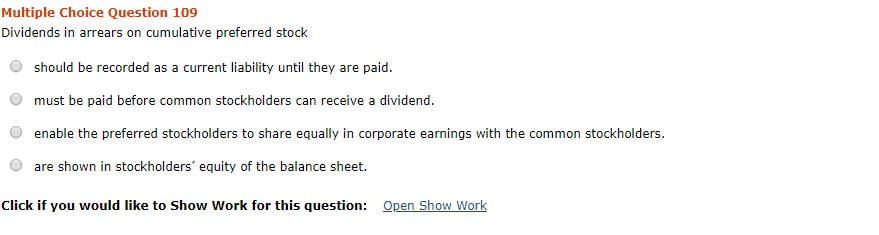

Solved Multiple Choice Question 109 Dividends In Arrears On Chegg Com

Chapter 13 Stockholders Equity Ppt Download

Noncumulative Overview Characteristics Advantages

Solved Preferred Stockholders Have The Right To Receive Chegg Com

What Happens If A Company Doesn T Pay Dividends To Stockholders

Rules And Rights Of Common And Preferred Stock Boundless Finance Course Hero

Preferred Stock Financial Edge

A Firm Has Issued Cumulative Preferred Stock With A 100 Par Value And A 12 Course Hero

Preferred Stock Common Stock Types Advantages Differences Video Lesson Transcript Study Com

:max_bytes(150000):strip_icc()/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

What Are Preference Shares And What Are The Types Of Preferred Stock

Dividend Yields On Preferred Stocks Have Soared This Is How To Pick The Best Ones For Your Portfolio Marketwatch

Solved 1 Which Of The Following Is Not True About Preferred Chegg Com

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

Accounting Ch 13 Flashcards Quizlet

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Common Stock Vs Preferred Stock Difference Between Common Stock And Preferred Stock Finance